Navigating Medical Device Regulation

Introduction to Brazil Medical Device Regulatory Guide 2024

The Brazil Medical Device Regulatory Guide 2024 offers a comprehensive roadmap for navigating Brazil’s medical device market, one of the largest in Latin America. Valued at $13 billion and growing at a projected annual rate of 5-7%, the market encompasses a vast array of products, from basic surgical gauze to advanced robotic surgery systems and MRI machines.

ANVISA (National Health Surveillance Agency) plays a pivotal role in ensuring device safety, efficacy, and compliance with stringent regulatory requirements. This guide delves into the essential aspects of device classification, registration pathways, stakeholder involvement, and future market trends.

Stakeholder Engagement and Transparency in Medical Device Regulation

Transparency and stakeholder collaboration are integral to the Brazil Medical Device Regulatory Guide 2024, ensuring an inclusive and effective regulatory environment.

Public Consultations and Inclusive Dialogue

- Public Consultations: ANVISA regularly invites stakeholders—including manufacturers, healthcare providers, and patient groups—to participate in shaping regulations. For instance, feedback during the drafting of RDC 751/2022 significantly influenced device classification criteria.

- Interactive Platforms: Stakeholders can submit feedback directly through online channels, ensuring continuous dialogue with regulatory authorities.

Advisory Bodies and Collaboration

- Technical Attributes Commission (TAC): Established under Portaria 261/2021, the TAC unites representatives from academia, government, and industry to ensure comprehensive evaluation of device attributes for pricing and compliance.

- Expert Panels: Advisory groups address emerging technologies, such as Software as a Medical Device (SaMD), providing evidence-based insights that inform regulatory updates.

Transparency Initiatives

- Interactive Dashboards: Real-time data on device pricing and availability is accessible through ANVISA’s dashboards, reducing information asymmetry.

- Annual Reports: Regularly published reports detail regulatory updates, stakeholder feedback, and market trends, fostering trust among participants.

Device Classification and Regulatory Pathways in Brazil Medical Device Regulatory Guide 2024

Device classification under the Brazil Medical Device Regulatory Guide 2024 follows internationally recognized risk-based standards, ensuring appropriate levels of oversight based on potential harm. Regulated by RDC 751/2022, the framework offers streamlined pathways for low-risk devices while ensuring stringent oversight for high-risk products.

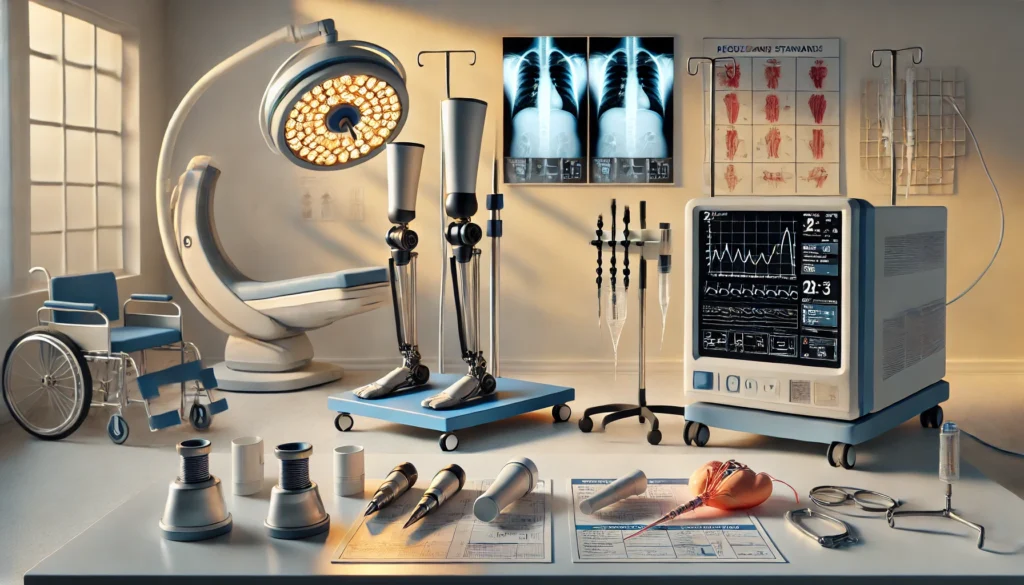

Risk Classes and Pathways

- Class I (Low Risk): Includes basic tools like surgical gauze, gloves, and tongue depressors, which require only a Notification process with minimal documentation.

- Examples: Surgical gloves, adhesive bandages, and tongue depressors.

- Pathway: Notification process requiring minimal documentation, such as technical specifications.

- Class II (Moderate Risk): Covers devices like digital thermometers, blood pressure monitors, and stethoscopes, requiring additional technical specifications and clinical performance data.

- Examples: Blood pressure monitors, diagnostic kits, and digital thermometers.

- Pathway: Notification with additional documentation, including performance data.

- Class III (High Risk): Examples include insulin pumps, orthopedic implants, and endoscopic tools, all subject to comprehensive Registration, including clinical safety reviews.

- Examples: Insulin pumps, dental implants, and orthopedic prosthetics.

- Pathway: Registration involving a detailed review of clinical efficacy and safety data.

- Class IV (Critical Risk): This class features pacemakers, defibrillators, and advanced imaging devices like MRI scanners, which undergo the most rigorous registration and clinical validation processes.

- Examples: Pacemakers, implantable defibrillators, and hemodialysis machines.

- Pathway: Rigorous Registration requiring extensive clinical trials and manufacturing site inspections.

Special Categories of Devices

- In Vitro Diagnostics (IVDs): Under RDC 830/2023, these include infectious disease tests (e.g., COVID-19 kits) and genetic diagnostics, classified by their public health impact.

- Personalized Devices: Governed by RDC 925/2024, personalized devices like 3D-printed implants follow tailored registration processes.

- Software as a Medical Device (SaMD): Regulated by RDC 657/2022, this category includes AI-powered diagnostic tools and digital health platforms.

Key Regulations Shaping Brazil’s Medical Device Market

Brazil’s regulatory framework, highlighted in the Brazil Medical Device Regulatory Guide 2024, ensures safety and efficiency throughout the device lifecycle.

Foundational Laws

- Lei 6.360/1976: Establishes Brazil’s health surveillance requirements for medical devices and related products.

- Decreto 8.077/2013: Details licensing and operational protocols for companies under health surveillance.

Critical Resolutions

- RDC 478/2021: Implements economic monitoring to ensure pricing transparency.

- RDC 751/2022: Defines risk-based classification pathways for device registration or notification.

- RDC 665/2022: Sets GMP standards for quality assurance throughout the manufacturing process.

- RDC 657/2022: Regulates Software as a Medical Device, addressing cybersecurity and performance.

Market Opportunities and Future Outlook Medical Device Regulatory Guide 2024

The Brazil Medical Device Regulatory Guide 2024 underscores Brazil’s position as a hub for innovation and market growth, attracting both local and international stakeholders.

Key Market

- Public Sector Demand: The Sistema Único de Saúde (SUS) drives large-scale procurement, particularly for essential devices like ventilators and diagnostic tools.

- Private Sector Innovation: Advanced technologies like robotic surgery and digital imaging are highly sought after in Brazil’s private healthcare sector.

- Foreign Investment: Brazil’s participation in the Medical Device Single Audit Program (MDSAP) simplifies market entry for global manufacturers.

Emerging Trends

- Digital Health Integration: SaMD and telemedicine solutions are transforming patient care, supported by regulations like RDC 657/2022.

- Sustainability Initiatives: ANVISA encourages eco-friendly practices, such as reusable surgical tools and sustainable manufacturing processes.

Final Thoughts: Unlocking Brazil’s Healthcare Potential

The Brazil Medical Device Regulatory Guide 2024 highlights Brazil’s evolving regulatory landscape, balancing strict compliance with opportunities for growth. With a $13 billion market driven by innovation and expanding healthcare infrastructure, Brazil remains a lucrative destination for medical device manufacturers.

To navigate Brazil’s complex regulatory framework, partner with Hegemoni Regulatory & Business Solutions. We specialize in regulatory compliance, market entry strategies, and tailored solutions for medical device companies.